In the last decade, Bitcoin has evolved from an obscure digital token to a financial powerhouse, capturing the attention of investors, technologists, and policymakers alike. Its emergence has signaled the advent of a whole new era in the financial realm, shaking the bedrock of traditional banking and reigniting discussions on the true nature of money. But what is the real impact of Bitcoin, and how is it reshaping our understanding of economic principles?

What Is Bitcoin?

At its core, Bitcoin is a decentralized digital currency without a central bank or single administrator that can be sent from user to user on the peer-to-peer bitcoin network without the need for intermediaries. Its creation by the mysterious Satoshi Nakamoto in 2009 has led to it becoming the first and most well-known cryptocurrency. Unlike traditional currencies, which are controlled by governments and financial institutions, Bitcoin is based on a revolutionary technology known as blockchain, making it inherently secure, transparent, and immutable.

The Rise of Bitcoin

Bitcoin’s meteoric rise in popularity can be attributed to its decentralized nature. The absence of intermediaries means that users have complete control over their own funds without the need for a central authority like a bank or government. This feature has made it extremely appealing to individuals seeking financial freedom and privacy.

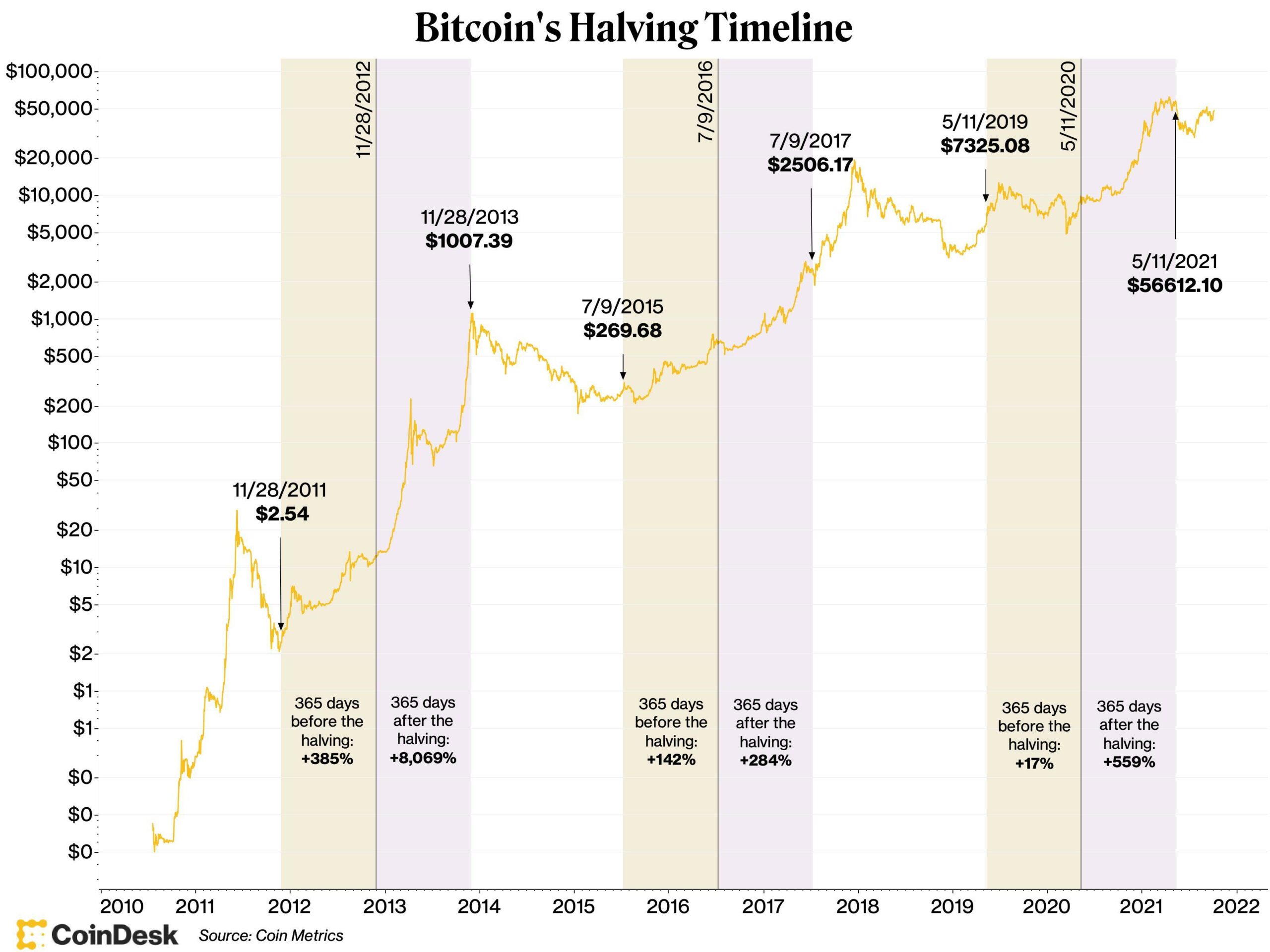

Moreover, the limited supply of 21 million bitcoins has also contributed to its value skyrocketing as demand continues to increase. As more investors flock to acquire bitcoin, its price has surged, reaching record highs in recent years.

Impact on Economic Principles

Bitcoin’s underlying technology, blockchain, has revolutionized the way we think about transactions and data management. Its decentralized architecture eliminates the need for trust between parties, as all transactions are recorded on a public ledger that is open for anyone to view.

This transparency not only makes it difficult for fraud or corruption to occur but also increases efficiency by eliminating the middleman in financial transactions. This has significant implications for economic principles such as supply and demand, as well as inflation and deflation.

Furthermore, as bitcoin gains mainstream acceptance and more businesses begin to accept it as a form of payment, its impact on traditional financial systems will continue to grow. With its secure and immutable nature, many experts believe that bitcoin could potentially replace traditional currencies in the future.

Challenges Ahead

While bitcoin’s potential is promising, there are still challenges that need to be addressed in order for it to reach its full potential. One of the main challenges is scalability – as more people use bitcoin, the network can become slow and expensive to use.

Another challenge is regulation. As a decentralized currency, there are many legal and regulatory hurdles that need to be overcome in order for bitcoin to gain widespread adoption. Governments around the world are still figuring out how to classify and regulate cryptocurrencies, which could impact their future success.

In addition, there have been concerns about the environmental impact of bitcoin mining. The process of verifying transactions on the blockchain requires significant amounts of energy, leading some critics to question its sustainability.

The Future of Bitcoin

Despite these challenges, experts remain optimistic about the future of bitcoin. As more and more businesses begin to accept it as a form of payment, its value and usage continue to grow. In addition, advancements in technology such as the lightning network are working to address scalability issues, making transactions faster and cheaper.

Furthermore, many see bitcoin as a potential store of value or hedge against inflation, especially with central banks around the world printing money at unprecedented rates. This has led some investors to view it as a digital gold that could potentially hold up in times of economic uncertainty.

However, there is still much debate about whether bitcoin can truly live up to these expectations and become a mainstream currency. Some argue that its volatility makes it unsuitable for everyday use and that other cryptocurrencies may have better technology and features.

How Does Bitcoin Work?

Bitcoin operates on a technology called blockchain, a distributed ledger that records all transactions across a network of computers. This ensures security and integrity as the ledger is immutable and cannot be altered retroactively. Bitcoin mining, the process by which new bitcoins are entered into circulation, is a critical component that involves solving complex computational problems to validate transactions and add them to the blockchain. This is also how the network maintains its decentralization, as no single entity or authority controls the creation of new bitcoins.

The Benefits and Drawbacks of Using Bitcoin

One of the main benefits of using bitcoin is its decentralization. Unlike traditional currencies that are controlled by central banks, bitcoin operates on a peer-to-peer network, meaning transactions can be made directly between individuals without intermediaries. This also means lower transaction fees compared to traditional payment methods.

In addition, many proponents argue that bitcoin offers increased security due to its use of blockchain technology. Transactions are encrypted and cannot be altered, making it nearly impossible for hackers to manipulate the system.

Potential Impact of Bitcoin

Decentralization of Control

Bitcoin, with its groundbreaking concept of decentralization, has revolutionized the way we perceive control and authority in the financial realm. By functioning on a transparent blockchain network devoid of a central authority, Bitcoin empowers individuals by minimizing dependence on conventional financial institutions. This transfer of power dynamics has the potential to catalyze significant transformations, not just within the financial sector, but also across socio-economic structures on a global scale.

New Investment Asset Class

Bitcoin has swiftly emerged as a distinct asset class, drawing interest from retail investors as well as institutional players. Its remarkable surge in value has at times surpassed the growth seen in conventional investments such as stocks and real estate, underscoring its role as a potential hedge against inflation and a valuable tool for diversifying investment portfolios. The decentralized nature of Bitcoin, coupled with its limited supply and increasing adoption, has positioned it as a novel and intriguing asset in the financial landscape.

Increased Financial Access

With just an internet connection and a digital wallet, individuals worldwide, regardless of their geographical location or social status, can easily access Bitcoin. This accessibility opens up a realm of financial inclusion opportunities for billions of unbanked people globally. By enabling them to save, invest, and actively participate in the global economy, Bitcoin serves as a gateway to financial empowerment and economic engagement for those previously excluded from traditional financial systems.

Catalyst for Innovation

The technology underlying Bitcoin, known as blockchain, has sparked innovation far beyond the realm of cryptocurrencies. This decentralized and secure system is not limited to financial transactions but is also being investigated for diverse applications. Industries like supply chain management, healthcare record keeping, and voting systems are actively exploring the potential of blockchain technology. Its ability to provide transparency, security, and efficiency is revolutionizing how various sectors operate and interact. The widespread adoption of blockchain is reshaping traditional practices and paving the way for a more secure and transparent future in numerous industries.

Regulatory Challenges

Bitcoin’s meteoric rise in value has presented numerous challenges, particularly concerning regulations. Various governments and financial regulatory bodies worldwide are currently wrestling with the delicate task of devising a framework that effectively balances the priorities of security, consumer protection, and the promotion of innovation within the cryptocurrency space. The ongoing debate revolves around the intricate process of integrating Bitcoin and other cryptocurrencies into the existing financial regulatory landscape, sparking intense discussions and raising multifaceted questions about the future of digital currencies.

Volatility and Security Concerns

Investors and observers must carefully consider Bitcoin’s price volatility, which can fluctuate significantly within short periods, and the security concerns associated with cryptocurrency exchanges, such as hacking incidents and regulatory uncertainties. While these factors indeed highlight the challenges, they should not overshadow Bitcoin’s underlying potential. It’s important to view these aspects as indicators of the cryptocurrency market’s early stage of development and its ongoing evolution, emphasizing the need for continuous monitoring and adaptation within this dynamic landscape.

Conclusion

Is Bitcoin the harbinger of a new era? Many signs point to ‘yes.’ With its combination of technological innovation, financial empowerment, and challenge to the status quo, Bitcoin has made an indelible mark on the 21st century. Still, it keeps the world watching closely to see what the future holds for this groundbreaking digital currency. As we continue on this path of digital transformation, it’s worth considering how Bitcoin and the technologies it has inspired can be leveraged for the greater good.

For those who care about Bitcoin and investment, the message is clear—stay informed, consider the risks, and be a part of the conversation. Whether you are a zealous advocate or a cautious observer, Bitcoin’s influence on the present and future cannot be underestimated.

Notice: This content is for informational purposes only and should not be taken as financial advice.